Downtown VAT Refund is now available for tourists who depart Thai

Who can claim a VAT refund

- Those who are not Thai nationality

- Those who have not a domicile in Thailand.

- Those who are not an airline crew member departing Thailand on duty.

- Depart Thailand from an international airport.

- Purchase goods from stores displaying a "VAT REFUND FOR TOURISTS" sign.

- Present the goods and VAT Refund Application for Tourist Form (P.P.10) and original tax invoices to the Customs officer before check-in at the airline counter on the departure date.

Vat Refund for Tourists conditions

- Goods must be purchased from stores displaying the "VAT REFUND FOR TOURISTS" sign.

- Goods must take out of Thailand with the traveler within 60 days from the date of purchase.

- Goods must be purchased at least 2,000 baht (VAT included) per day per store.

- On the purchasing date, tourists must present passport and ask the sales assistant to issue the VAT Refund Application for Tourists form (P.P.10) with the original tax invoices.

- Tourists must present the goods and VAT Refund Application for Tourists form (P.P.10) with original tax invoices to a Customs officer for inspection before check-in.

- In case of luxury goods (jewelry, gold, ornaments, watches, glasses, and pens of which the value is over 10,000 baht), the tourist is required to hand carry and show the goods again at the VAT Refund for Tourists

- Office, after passing the immigration checkpoint.

Tourists can claim a VAT refund at the VAT Refund for Tourists Counter at an international airport, or drop the documents into the box in front of the VAT Refund for Tourists office, or mail the documents to the Revenue Department of Thailand.

Vat Refund Payment Methods

For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a

1.1 Cash (Thai baht only) or

1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or

1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB)

2. For refund amount exceeding 30,000 baht, the refund payment can be made in the form of bank draft or transfer into a credit card account (as detailed in 1.2 and 1.3)

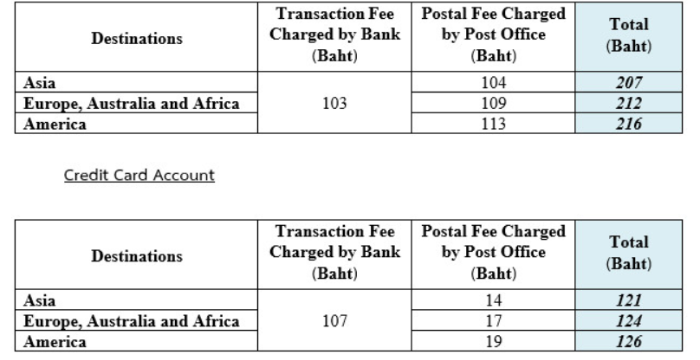

The expense consist of draft or transfer fee, and postal fee which are charged by banks and post office and they will be deducted from the refund amount. Below tables are shown the approximately rate of the expenses.

*The postal fee depends upon distances and weights of the letter

Why the VAT refund are disapproved

- A claimant carries a diplomatic passport and/or resides in Thailand.

- A claimant is an airline crew member that is on duty when departs Thailand.

- A claimant did not depart Thailand from an international airport.

A claimant did not carry the goods out of Thailand on the departure date. - Goods were not taken out of Thailand within 60 days from the date of purchase. The purchase date is counted as the first day.

Goods were taken out of Thailand without inspected by a Customs officer. - Luxury goods were taken out of Thailand without inspected by a Revenue officer.

- The total value of purchase is less than 2,000 baht per day per store.

- The VAT Refund Application for Tourist form (P.P. 10) was not issued on the date of purchase.

- The name or passport number on the original tax invoices that are enclosed to the VAT Refund Application for Tourist form (P.P. 10) is not a claimant.

- The original tax invoices were not enclosed to the VAT Refund Application for Tourist form ( P.P. 10).

- Goods were not purchased from the shops participating in the VAT refund for tourists scheme.

- The tax invoices were not issued from a store that mentioned on the form.